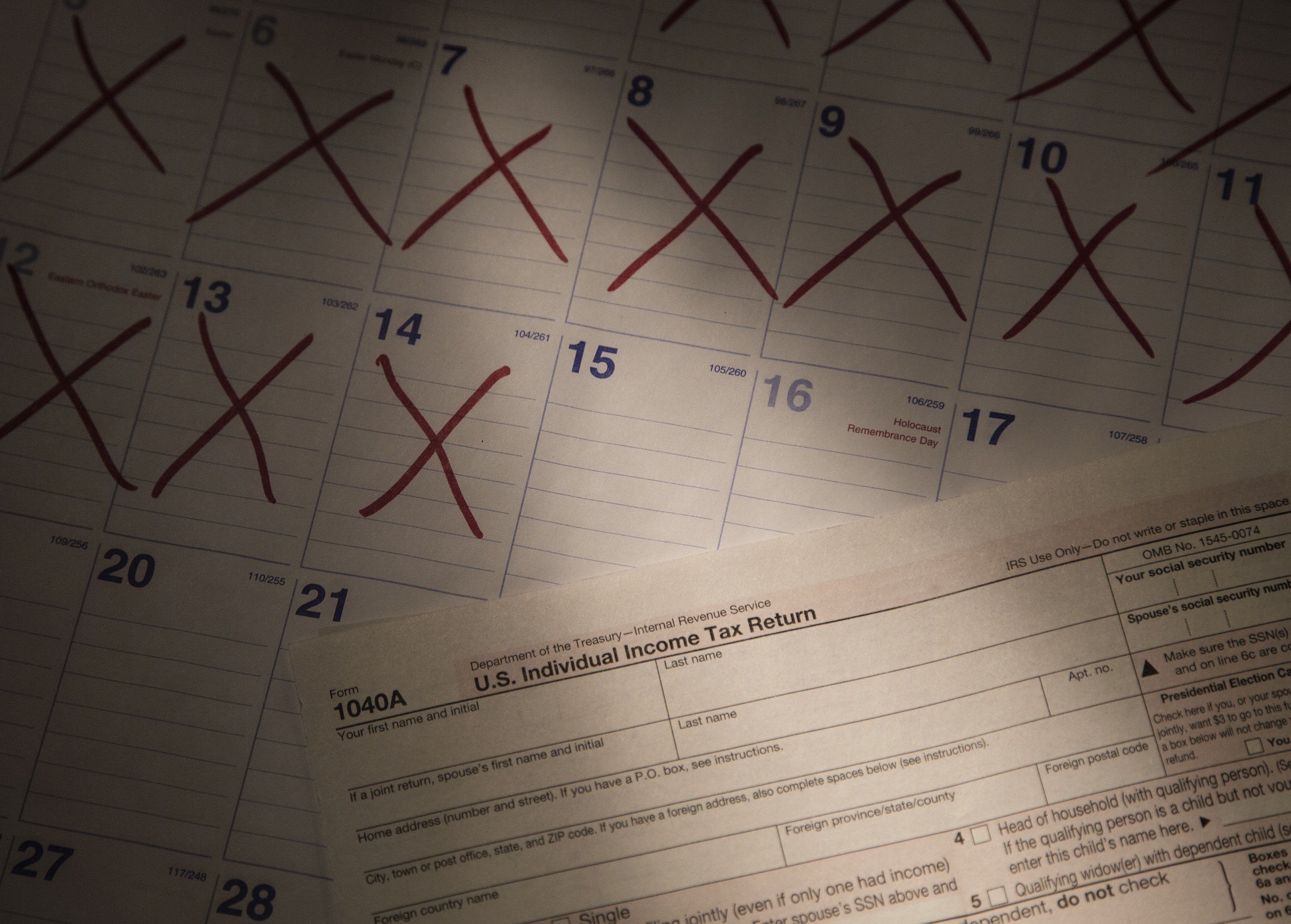

DePaul University faculty experts are available to provide commentary on tax season from a variety of angles including identity theft, fraud, international laws and procrastination. (Photo by Jamie Moncrief)

DePaul University faculty experts are available to provide commentary on tax season from a variety of angles including identity theft, fraud, international laws and procrastination. (Photo by Jamie Moncrief)CHICAGO — Tax season isn’t just about getting a refund; there are many other factors that consumers face. DePaul University faculty experts are available to provide commentary on tax season from a variety of angles including identity theft, fraud, international laws and procrastination.

Experts available for news interviews include:

Jacob Furst, professor, College of Computing and Digital Media. Furst is an expert in computer security and is the director of the DePaul Information Assurance Center. He teaches courses in information security, secure electronic commerce, and networking and security. “Identity theft is a serious concern, and where taxes are concerned, it almost always means your Social Security number has been compromised,” said Furst. “The good news is, the IRS is aware of the problem and has resources people can use to protect themselves, and recover from fraudulent tax filings.” He adds, “The keys to prevention and recovery are diligence and vigilance.” Furst can be reached at jfurst@cdm.depaul.edu or 312-362-5158.

Kelly Richmond Pope, associate professor, Driehaus College of Business. Pope is an expert in forensic accounting. She can speak to tax fraud and white-collar crimes such as money laundering, insurance fraud and risk management. “If you suspect tax fraud, you should report the incident using Form 3949-A and submit it to the IRS,” said Pope. “Tax preparer fraud is prevalent; always remember that it is up to you to determine if your preparer is legitimate.” Pope can be reached at kpope2@depaul.edu or 312-362-5821.

Emily Cauble, associate professor, College of Law. Cauble teaches courses in international taxation, corporate taxation, contracts, and federal income tax and policy. “Many U.S. citizens who live abroad may not realize that they are potentially subject to U.S. tax on much of their income,” she said. Cauble can be reached at ecauble@depaul.edu or 312-362-5948.

Joseph Ferrari, professor, College of Science and Health. Ferrari is a psychologist and expert in chronic procrastination. He has done extensive research on the subject of procrastination and can speak about why people wait until the last minute to do their taxes. “My research has found that 20 percent of men and women in the U.S. are chronic procrastinators. They delay at home, work, school and in relationships, so it is no doubt that they are going to procrastinate when filing their income taxes,” said Ferrari. “Procrastinators also tend to wait until late at night to begin unpleasant tasks and that’s why they will wait until the 11th hour on April 15 to work on their taxes.” Ferrari can be reached at jferrari@depaul.edu or 773-325-4244.

###

Media Contact:

Wendy Zamaripa Smit

wsmit@depaul.edu

312-362-7749